At the McKinsey Global Infrastructure Initiative Summit, McKinsey shared findings that outlined both the impacts of the COVID-19 pandemic on the construction industries and how technology is playing a role in its recovery. The pandemic has thrust the construction industry into a new, more digital, and more remotely connected area, and the report has found that those companies that had either invested in new technologies prior to or during the pandemic are doing better than those that did not.

While we all hope that the industry bounces back, it is apparent that it will not be going back to “normal” – and that’s an opportunity for disruption and growth.

In the report, McKinsey outlines some of the trends that were short-term, and those that have the potential to have longer-term impacts:

- Short term: Increased digitization. Organizations across the industry are shifting to remote ways of working. For instance, designers and engineers are relying even more heavily on digital collaboration tools such as building-information modeling (BIM). Leading engineers and contractors are using 4D and 5D simulation to replan projects and reoptimize schedules. Integrated digital-twin solutions are being developed to be used end to end, from project concept to commissioning. And contractors are looking to online channels for monitoring their employees’ well-being through apps, ordering construction materials, managing scarce resources more accurately, and maintaining cash flow.

- Short term: Rebalanced supply chains toward resilience (versus efficiency). Contractors are building inventory, securing critical materials and long-lead items, and identifying alternative suppliers.

- Long term: Augmented consolidation. Players are looking to consolidate to establish economies of scale and support investment in IT, talent, R&D, and technology. Furthermore, companies and investors will increasingly look to consolidation for much-needed resilience in their balance sheets.

- Long term: Vertical integration. Industry players are already starting to vertically integrate to increase efficiency and as a route to standardization and control of design and execution. In a post-crisis world, vertical integration (which may include a return to greater reliance on direct labor) is a potential route to greater resilience. This is the case in industrial asset classes, where equipment manufacturers are experimenting with integrating forward in the value chain and often moving from building to assembling industrial plants. And in real estate, many vertically integrated players are emerging with new business models.

- Long term: Further investments in technology or digitization and innovation of building systems. The industry faced a shortage of skilled labor before the crisis. With the prospect of rolling physical-distancing measures and restrictions on cross-border movement of labor, skilled labor shortages will become even more acute. The case for digital tools that are proven to increase productivity, such as 4D simulation, digital workflow management, real-time progress tracking, and advanced schedule optimization, will become even stronger. For similar reasons, we see an increase in R&D spending to develop new standardized building systems to speed up and automate elements of design and construction. We also expect to see more players investing in automation of on-site and back-office processes.

- Long term: Increase in off-site construction. Building in controlled environments makes even more sense in a world that requires close management of the movement and interaction of workforces. Such rationale further strengthens the case for off-site construction, beyond the existing quality and speed benefits. In fact, we expect to see contractors gradually push fabrication off-site and manufacturers expand their range of prefabricated subassemblies.

- Long term: Acceleration toward sustainability, including designs for healthier living. Governments may stimulate the economy by encouraging measures to meet carbon reduction targets—for example, by retrofitting housing stock to improve energy efficiency. Such incentives might come in the shape of a combination of policy changes and direct public investments. We expect to see a parallel shift in demand toward more sustainable buildings and communities that promote healthier lifestyles (such as access to local amenities and outdoor space, higher standards on air quality, and recycled and sustainable materials).

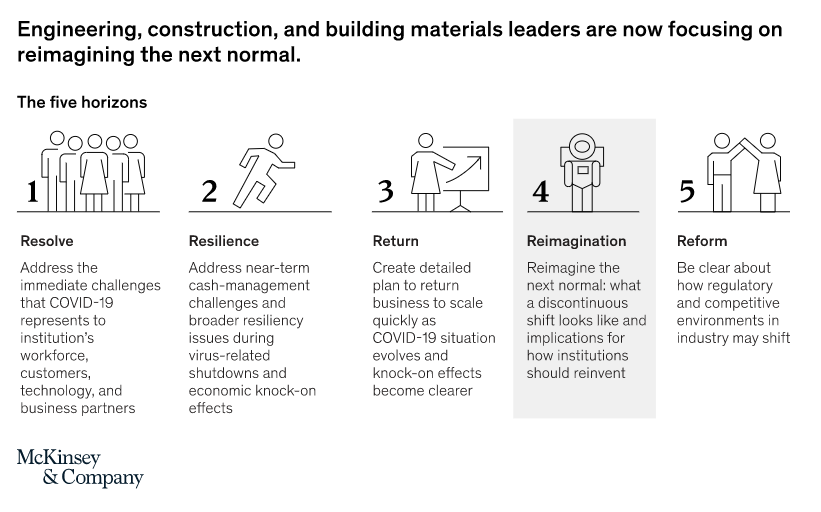

They also highlight “five horizons” for returning to normal, which include re-imagining the “next normal” that includes new digital processes.

The article outlining the findings is posted on McKinsey’s website, and more information about the return to work can be found at the Global Infrastructure Initiative Summit.